The Key Advantages of Investing in Multi-Family Real Estate in Edmonton

July 23, 2021 7:00 am

Investing in multi-family real estate is one of the best strategies for Edmonton investors wanting to benefit from additional monthly income and slow and steady property appreciation.

But that’s not all.

Here are 11 key advantages to invest in multi-family real estate in Edmonton:

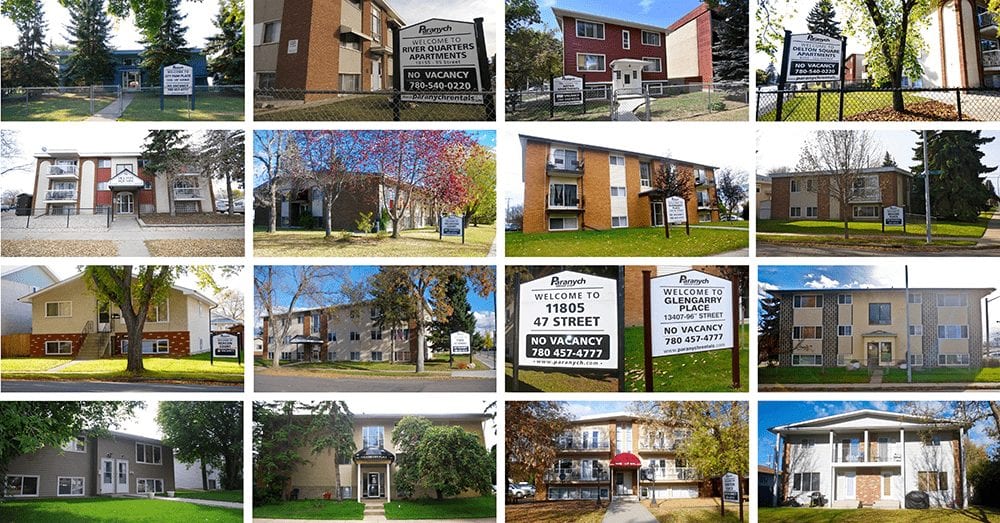

What Is Multi-Family Housing?

Simply put, multi-family housing refers to two or more units contained within one building or group of buildings. A broad term, multi-family real estate extends across various home styles, price points, locations and includes duplexes, triplexes, fourplexes, apartment-style condos and townhomes.

1. Strong Rental Demand in Edmonton

Regardless of any transitional ups and downs of the last 24 months, Edmonton’s economy remains stable thanks to several non-oil and gas-related sectors, including education, healthcare and construction. As a result of Edmonton’s mixed economy, demand for multi-family rentals remains high (a trend expected to continue due to the province’s recovering energy industry).

Currently, 35% of Edmonton’s population relies on rental properties for housing – giving multi-family investors a competitive edge in tenant demand.

2. Multiple Sources of Income

Edmonton remains the fifth-largest city in Canada. As the city has increased in popularity and size, so too has the need for multi-family homes among first-time buyers, working professionals, downsizers and growing families looking for an affordable home. These conditions are ideal for multi-family investments, which will allow savvy investors to take advantage of multiple income streams at once.

Additionally, multi-family investments allow investors to reduce their risk. Unlike a single-family home that may go unoccupied for months, multi-family properties allow you to spread the risk across several units. Should one unit go unoccupied, other rents will cover most (if not all) associated expenses.

3. Build Long-Term Wealth, Faster

Like most lucrative real estate investments, multi-family real estate can deliver financial security over the long term. However, by investing in two or more units at once, you have the potential to build wealth and equity faster than with a single property investment alone. Moreover, with each tenant payment, you can put this equity to work in numerous ways, including funding your retirement, putting a down payment on your next home or series of investment properties and more.

4. More Bang For Your Buck

Depending on how and where you choose to invest in multi-family housing in Edmonton, two or more units will generally prove more affordable than investing in a single-family property. This allows investors to double (triple or quadruple) their income stream at a fraction of the cost. Acquiring several multi-family units at once has also been proven to take far less time and money than acquiring several single-family homes, where investors are forced to deal with multiple closings, deadlines, etc.

5. Diverse Product Types

Multi-family is a vast sector including several product types. This allows investors to be more selective in terms of cost per unit, as well as the Edmonton neighbourhood in which they’d like to invest and the type of tenant they’d like to target.

For instance, you may choose to purchase family-oriented duplexes or triplexes in an established neighbourhood. Or, you may opt to target students and young working professionals by investing in high or low-rise apartments close to downtown. Finally, you may prefer to invest in a newer neighbourhood known for its adult-only townhomes.

Are you considering buying a multi-family rental property in Edmonton? Find out Why It’s Critical You Choose A REALTOR® with Years of Real Estate Investment Experience.

6. A Hedge Against Inflation

Because lease terms generally span no more than 12 months at a time, multi-family investors are always in a position to benefit from improving market conditions. As inflation increases, so do rental rates, allowing investors to collect more while maintaining their fixed-rate monthly mortgage payments. In short, as a multi-family investor, you’ll be able to pay your mortgage loans off faster as you enjoy a surplus of passive rental income.

7. Tax Deductions

The Canadian Government provides several tax-related benefits to real estate owners, covering everything from lower interest rates to deductions related to property depreciation, insurance, legal fees and more.

The following is a list of deductible expenses as per the Canadian Revenue Agency:

- Advertising

- Insurance

- Interest and bank charges

- Office expenses

- Professional fees (includes legal and accounting fees)

- Management and administration fees

- Repairs and maintenance

- Salaries, wages, and benefits (including employer’s contributions)

- Property taxes

- Travel

- Utilities

- Motor vehicle expenses

- Other rental expenses

- Prepaid expenses

8. Property Appreciation

Due to the high demand for affordable rental options in Edmonton, multi-family homes retain consistently high values. Long-term appreciation paired with any property improvements you choose to undertake will also help you secure a steady increase in year-over-year value.

Note: Damage deposits and rental contracts associated with most multi-family units also serve to protect your investment and the property’s overall value.

9. Owner-Occupied Benefits

Depending on your unique goals, you may opt to claim one multi-family unit as your own. Not only will this allow you to remain close to your tenants (no commuting back and forth) and reduce tenant-related problems, but it will also provide you with additional financial benefits, including a decreased down payment and further tax incentives.

See our previous post: The Top Reasons Why Your First Home Should Also be an Investment Property

10. Easier Property Management

Managing several single-family properties across a variety of locations can be nothing short of challenging. Single-family properties can make it harder to justify costs associated with property management and may require multiple managers and insurance companies. Multi-family properties, on the other hand, will generate enough income to hire a single property manager to oversee day-to-day operations while decreasing the impact of maintenance and repairs.

11. Diversify Your Portfolio

While real estate is an essential component of any diversified portfolio, multi-family investments are especially ideal. Future demand combined with low risk, long-term appreciation, tax benefits and value-add opportunities make multi-family properties particularly attractive. Not to mention, you can benefit from acquiring multiple properties in no time at all – a more efficient approach to purchasing one property at a time.

For more information on investing in Edmonton real estate, reach out to us! We also invite you to visit our Real Estate Investing blog and/or download your FREE copy of our guide, How to Create Amazing Wealth: A Beginner’s Guide to Investing in Real Estate. This comprehensive guide will teach you everything you need to know about:

- The Advantages of Investing in Real Estate

- Learning the Basics

- How to Find Your Real Estate Niche

- Preparing Your Finances

- Finding the Right Property in the Right Neighbourhood

- How to Secure Multiple Income Streams

- The Importance of Working With an Experienced Real Estate Investment REALTOR®

- And more!

Photo credits: money house, diverse products

Tags: investingCategorised in: Real Estate Investing

This post was written by Terry Paranych Real Estate Group